A monthly insurance premium is the cost a business owner pays each month to cover employee health insurance benefits. Questions arise about where the cost of insurance comes from—how is the price of a premium determined? The premium amount may seem arbitrary or unnecessarily high, which can be frustrating for employers and employees.

There are many factors taken into consideration when an insurance premium is calculated that may not seem evident or obvious. Let’s take a look at how pricing is established.

Group health costs are a collection of all enrolled employees

For group health coverage, premiums are calculated for each employee who enrolls in an employer’s health plan (plus the cost to add a spouse and/or dependents). All of those individual premiums are added together to get the group’s total premium for a specific health plan. (Most employers require employees to pay some of the costs for their health insurance, and the employer takes care of the monthly payments to the insurance company.)

Medical underwriting and small group plan pricing

Medical underwriting is a process that evaluates whether to accept an applicant for health coverage and/or to determine the premium rate for a plan—all based upon several risk factors with the overall medical history of the group factoring into the premiums.

Depending on the insurance company's policies and on federal and state regulations, medical underwriting for high-risk candidates may lead to exclusion of coverage for certain conditions, denial of coverage altogether, or coverage offered only at a very high price.

Since 2014, medical underwriting is no longer used in the individual or small group (less than 50 employees) fully insured markets, due to Affordable Care Act rules. Instead, all individual and small group plans are guaranteed issue—which means that health plans must permit enrollment in a health plan regardless of health status, age, gender, or other factors that might predict the use of health services.

Which factors can affect your small group (under 50 employees) insurance rates?

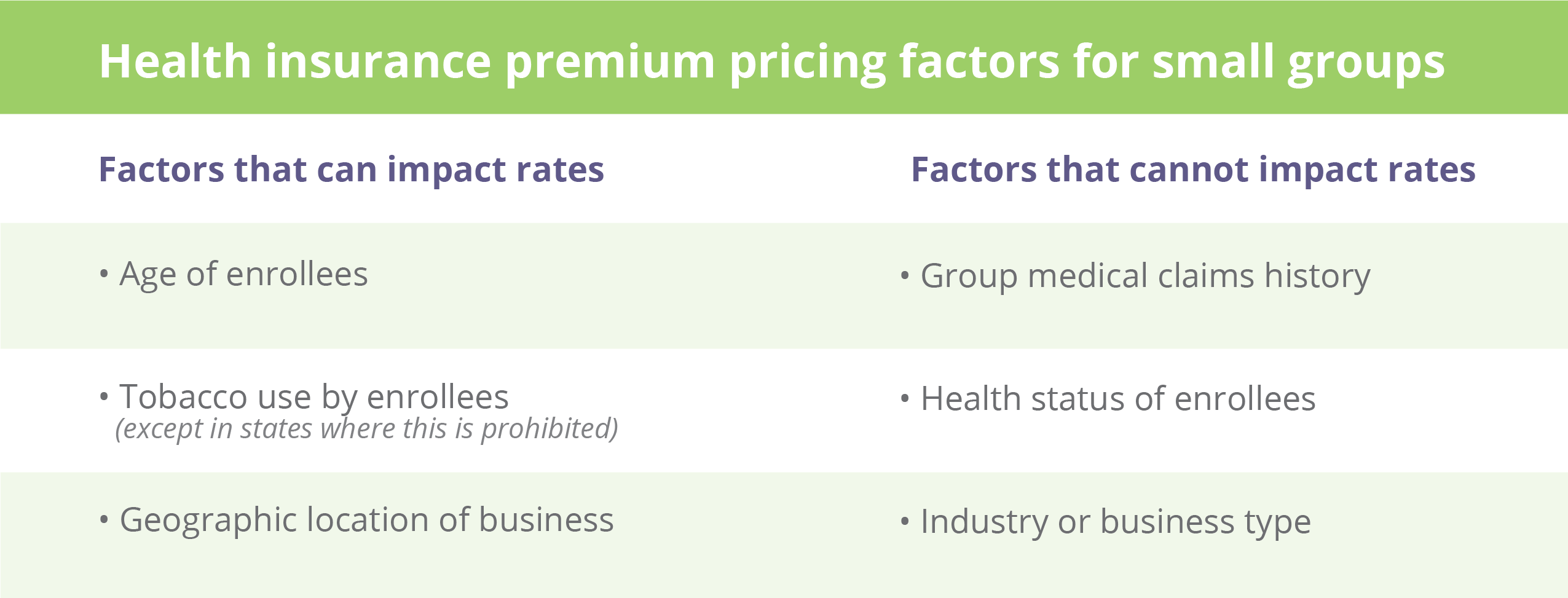

Health insurance premiums can differ from one health plan to another based on how comprehensive the benefits are, the size of the insurer’s network, and other variables. The Affordable Care Act doesn’t allow small group insurance rates to be based on:

- The group’s overall medical claims history

- The health status of individual enrollees

- The group’s industry or business type

Premiums for any specific plan in the small group market can only vary based on three factors:

- The ages of employees and their dependents

- Tobacco use among employees and dependents

- The location of the business

Age of enrollees

The ages of your employees and their spouses/dependents are typically the most significant factor in determining your group’s total premiums.

The base rate is the rate for a 21-year-old. Premiums are typically lower for people younger than 21 and higher for people over 21. The maximum that older enrollees can be charged is three times the base rate for 21-year-olds.

For employees who have family coverage, the total premium is determined by adding together the age-based (and tobacco-based, if applicable) premiums for each family member. But if the family has more than three kids under the age of 21, premiums are only charged for the three oldest kids, although all of them are covered. (This only applies for children under the age of 21).

Tobacco use

Under the Affordable Care Act (ACA), group health plans can charge tobacco users up to 50% more for their health insurance premiums than non-tobacco users, and when they do this it is called a tobacco surcharge.

Geographic location

Under the ACA, small group health insurance premiums can vary based on geographic area.

Qualified Health Plans are permitted to impose higher rates on individuals and families who live in areas where medical costs are higher, and each state is responsible for establishing the rating areas to be used for these purposes. (An insurance plan is qualified if it’s certified by the Health Insurance Marketplace®, provides essential health benefits, follows established limits on cost, and meets other requirements under the Affordable Care Act. All qualified health plans meet the Affordable Care Act requirement for having health coverage, known as “minimum essential coverage.”

The difference in premiums has to be due to something other than the overall health of the people in each area. That means an insurance company can’t charge higher premiums in one area just because the people in that area tend to be in poorer health.

Instead, the geographic premium differences have to be based on factors like the cost of healthcare. So, premiums can be higher in areas where providers tend to charge higher prices for medical care and in areas where insurers don’t have as much leverage in negotiating lower prices with hospitals and doctors.

How are annual health insurance rates set?

Health insurance companies submit proposed rates for small group plans—and justification for those rates—to the state department of insurance. This is done annually.

Once the rates are approved by the state, they are set for a full year. This means that other employer groups in the same region with similar demographics will be paying the same rates. Unlike the large group health insurance market, there’s no wiggle room to negotiate with insurers in the small group ACA market.

Large employer groups are priced according to many additional factors.

Rating rules are different for large group plans where insurers can base premiums on the group’s claims history and type of industry, as well as factors like employees’ ages and the location of the business.

The cost of a large group plan is based on several variables, different from a fixed (ACA) rate. The premiums, coverage, deductibles, and benefits are based on several factors:

- The number of employees participating

- The type of coverage needed

- The amount of payments, deductibles, and benefits

- An employer’s prior claims history

Other factors that can impact health insurance premiums for large groups:

- Average age of the workforce

- Large claims that have been made by the employer previously

- Employer’s geographic location

- Gender makeup of the workforce

- Employment sectors

What can employers do to keep premium costs down?

- Encourage employees to take advantage of preventive benefits.

- Offer an employee wellness program and/or incentive. Keeping employees healthy and active can help reduce premium costs.

- Offer telemedicine services as part of the benefit plan.

- Offer employees the ability to open and use a Health Savings Account.

- Pay close attention to pharmacy benefits—one of a plan’s largest expenses.

- Compare insurance providers. Because there’s so much variation among insurance plans, each provider offers different plans and options. That’s why you’ve got to shop around before choosing a plan.

- When comparing providers, though, the lower premium isn’t always the best deal. Keep in mind that a low-cost health insurance provider may also come with downsides. For example, lower premiums may force you to sacrifice a broader network. And, low initial rates may climb quickly. So, look at the overall provider, their mission, philosophy, and service availability.

PHP works to keep costs down and customer satisfaction up

PHP employs industry-leading data analytics and solutions to help clients control costs, expand coverage, and untangle regulatory complexity to improve the health and well-being of our members and our community.

PHP uses numerous tools to help determine health risks associated with expensive claims against benefit plans. PHP strategically evaluates every case to uncover all applicable risks our employer groups face and to help mitigate those that can be lessened. Also, we work to keep our premium costs at a reasonable level while protecting an employer’s financial interests.

REFERENCE and RESOURCES:

Mint: